25+ Home mortgage rates today

A loan that is either. See todays rates in context.

Help My Client Is Questioning Pr Value What Should I Do Como Economizar Dinheiro Pagar Dividas Financas

30-Year Fixed Rate.

. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. Use our calculator to see estimated rates today for mortgage and refinance loans based on your specific needs. A point is a fee paid to a lender equal to 1 percent of the.

For instance in February 2010 the national average mortgage. A good rule of thumb is six months of mortgagetax and insurance for loans under 750000 and 12 months for jumbo loans says Melissa Cohn an executive mortgage banker at Connecticut-based. Todays Mortgage Rates Who Determines Interest Rates.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. Our 20 years of local experience and knowledge means you can trust HomeRate Mortgage because our team has proven they can get your new home loan Approved. See home loan rates from top lenders customized to you.

30 year fixed mortgage rates. Mortgage rates are still low by historical standards across the board. 606 706 APR 5980 250 Margin.

Todays national mortgage rate trends. Qualifying for the best rate. Call us at 651-747-4663 or Make an Appointment for rates and to learn more.

Current and historical mortgage rate charts showing average 30-year mortgage rates over time. Compare todays mortgage rates in Ontario all in one place. Since variable mortgage rates and home equity lines of credit HELOCs are directly tied to a lenders prime rate when the BoC hikes.

But not every borrower will. The average mortgage interest rate for a standard 30-year fixed mortgage is 592 an increase of 032 percentage points from last weeks 560. Based on data compiled by Credible three key mortgage rates for home purchases have risen and one remained unchanged since yesterday.

Mortgage rates vary depending upon the down payment of the consumer their credit score and the type of loan that will be acquired by the consumer. See current mortgage rates. On Tuesday September 6th 2022 the average APR on a 30-year fixed-rate mortgage rose 1 basis point to 5992The average APR on a 15-year fixed-rate mortgage fell 5 basis points to 5185 and.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. We make it easy to compare the best mortgage rates in Ontario for free. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

30-year fixed mortgage rates. Get Your Custom Rate. Get an Instant Streamlined Preapproval in 3 minutes without affecting your credit score.

According to data released Thursday by Freddie Mac the 30-year fixed-rate average climbed to 555 percent with an average 08 points. Mortgage rates on 51 ARMs are often lower than rates on 30-year fixed loans. Are based on a fixed-rate period of 5 years that could change in interest rate each subsequent year for the next 25 years a down payment of 20 and borrower-paid finance charges of 0862 of the base loan amount.

Thirty-year fixed mortgages are the most commonly. Based on data compiled by Credible mortgage rates for home purchases have fallen across all terms since last Friday. Banks and other mortgage lenders also increase their prime lending rates.

What this means. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. 5125 down from 5625 -0500.

What are todays second home mortgage rates. The loan is secured on the borrowers property through a process. National Association of Home Builders.

What sets 51 ARMs apart is that the interest rate is only fixed for the first five years of the term and then the rate adjusts annually for the remaining 25 years. Find and compare 30-year mortgage rates and choose your preferred lender. First time homebuyer.

Fixed - Zero Down - Conventional 2. Call us at 651-747-4663 or. What this means.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. When the rate starts adjusting after the fixed period ends it could go up or down. Browse and compare todays current mortgage rates for various home loan products from US.

FNMA or the Federal Home Loan Mortgage Corporation FHLMC. 30-year fixed mortgage rates. If you are using the reverse mortgage for a new home purchase or are already taking most of your available funds at closing to pay off another mortgage balance you.

A credit score of 640-679 with a down payment of 25 or more. Rates for a 30-year mortgage refinance rested today while rates for all other repayment terms edged upRates for 20- and 15-year terms rose slightly while 10-year rates rose a. Check rates today to learn more about the latest 30-year mortgage rates.

View todays reverse mortgage interest rates APR read our 3 tips to help decide which interest rate is. Get into your new home sooner. Rates for a 30-year mortgage refinance rested today while rates for all other repayment terms edged upRates for 20- and 15-year terms rose slightly while 10-year rates rose a.

Ideal Mortgage Rates. 15 year fixed mortgage rates.

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

A Residential Bridge Loan Is Ideal For You If You Want To Avoid Moving 2 Times Apply Equity From Your Old Home To Your Washington Dc How To Apply Bridge Loan

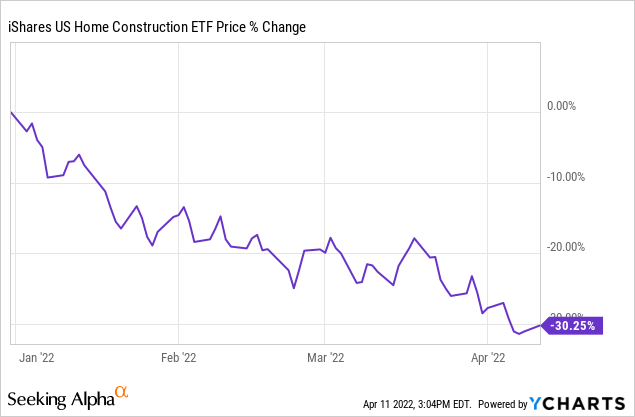

A Clear Warning Signal For The Housing Market Seeking Alpha

Learn How To Evaluate Multi Family Investment Properties Investment Property Real Estate Investing Rental Property Commercial Real Estate Investing

Best Refinance Offers 25 Years Of Experience As Reliable Second Mortgage Broker In Mississauga

Real Estate Vocabulary Real Estate Marketing Design Luxury Real Estate Agent Real Estate Quotes

Looking For Car Loan Car Loans Loan Business Loans

Personal Loans Personal Loans Loan How To Apply

Loan Modification Specialist How Not To Get Ripped Off Real Estate Investment Group Home Equity Property Management

Personal Loan Personal Loans Banks Ads Photo Album Layout

The 25 Best Apps For Realtors In 2022 That Agents Teams Love Real Estate Tips Real Estate Real Estate Infographic

:max_bytes(150000):strip_icc()/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

5 Things You Need To Be Pre Approved For A Mortgage

What Comes After A Seller Accepts Your Offer Infographic Real Estate Tips Real Estate Infographic Real Estate Marketing

Daily Habits Of 8 Top Real Estate Agents Real Estate Infographic Top Real Estate Agents Real Estate Tips

How Refinancing Your Student Loans Can Save You Thousands Conscious Coins Paying Off Student Loans Student Loans Refinance Student Loans

What Goes Into A Home Appraisal 25 Things Appraisers Will Note And Why They Care In 2022 Home Appraisal Appraisal Real Estate Tips

25 Ways To Make Money As A Real Estate Agent Real Estate Tips Real Estate Agent Real Estate Agent Marketing